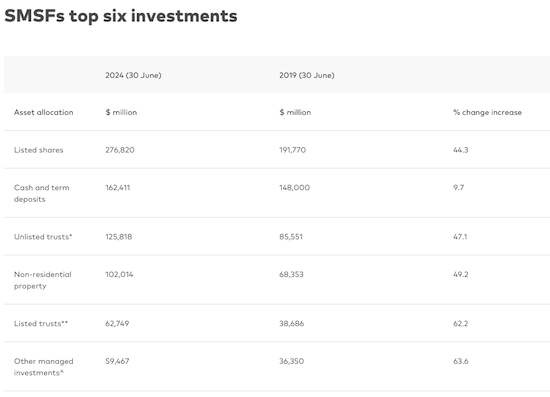

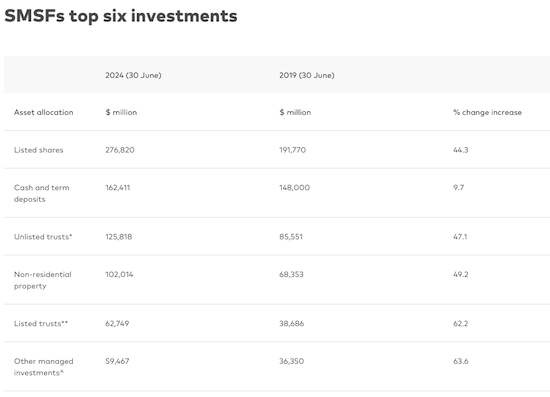

The biggest assets growth areas for SMSFs

.

vanguard.com.au

.

Latest News

Louise founded Salus Private Wealth to offer high quality personal advice to clients who want to work closely with an adviser for the long term. Her philosophy that understanding each individual and their motivations and needs is key to an enduring and successful financial planning relationship is at the heart of the business.

She first engaged the services of a financial adviser herself when she was in her early 20s (long before becoming one) and believes the non-judgemental support and education about her position and options provided at this early stage has allowed her to make confident decisions in different aspects of life since then.

This confidence and positivity in making choices, financial or not, is what she wants to give to her clients.

Superannuation is one of the largest and longest duration investments most people in Australia have, making it a critical part of long-term planning even if retirement feels like a distant objective. For those in the lead into retirement, we design strategies so you have peace of mind that when you start to draw on your retirement savings, you have liquidity and stability to support that.

Legislation and rules are changed regularly, so advice can help you take advantage of opportunities to build for the future. We are authorised to provide advice on and to SMSFs.

Contact us today to discuss how we can work together: (02) 8044 3057 or email us at info@saluspw.com.au

Protecting your wealth, lifestyle and family is high on the priority list for many clients and this is an area of advice need that can change very quickly. Ensuring you have the cover you need can give peace of mind that what’s important is taken care of in the event of illness, injury and death, but we also make sure over time you are not paying for cover you no longer need.

Contact us today to discuss how we can work together: (02) 8044 3057 or email us at info@saluspw.com.au

While talking about death doesn’t seem like a particularly appealing prospect, it’s a topic we see as a vital part of financial planning. Importantly, it’s a topic for every adult, regardless of their stage in life. Without a proper estate plan assets may not be passed where you’d like them to go, family conflict can ensue, and in the event you lose capacity there may not be an authority in place for the person you would choose to make those decisions for you to do so. While it can be an uncomfortable subject, we are experienced in facilitating these conversations as part of our advice process.

Contact us today to discuss how we can work together: (02) 8044 3057 or email us at info@saluspw.com.au

Managing debt efficiently can have a material impact on your financial wellbeing and lifestyle. Having a solid plan to understand where your money goes and manage cashflow and debt can eliminate stress and set you on a positive path toward achieving your goals.

Contact us today to discuss how we can work together: (02) 8044 3057 or email us at info@saluspw.com.au

Once we have a clear understanding of what we are aiming for and how you feel about taking on investment risk, we can help direct your funds into appropriate investments to meet your goals. This includes recommending the investment structure, consideration of tax implications, asset types, and putting together a suitable blend for you. You will have transparency of and access to view your investments, providing security.

Contact us today to discuss how we can work together: (02) 8044 3057 or email us at info@saluspw.com.au

Aged care needs can arise suddenly. The complexity of managing this can be a significant challenge at a time when your focus should be on the person requiring care. We can assess the alternative funding options to ensure you make an informed choice in the best interests of the person requiring care.

Contact us today to discuss how we can work together: (02) 8044 3057 or email us at info@saluspw.com.au

Secure File Transfer is a facility that allows the safe and secure exchange of confidential files or documents between you and us.

Email is very convenient in our business world, there is no doubting that. However email messages and attachments can be intercepted by third parties, putting your privacy and identity at risk if used to send confidential files or documents. Secure File Transfer eliminates this risk.

Login to Secure File Transfer, or contact us if you require a username and password.

The Trustee for Laing Weaver Family Trust T/A Salus Private Wealth (Corporate Authorised Representative No. 1305571) and all our advisers are Authorised Representatives of Finchley & Kent Pty Ltd, Australian Financial Services Licence No. 555169, ABN 50 673 291 079, and has its registered office at Level 63, 25 Martin Place, Sydney NSW 2000.

Finchley & Kent Pty Ltd Australian Financial Services Licence applies to financial products only. Please note that Property Investment, Tax & Accounting, Mortgages & Finance are not considered to be financial products.

Disclaimer: The information contained within the website is of a general nature only. Whilst every care has been taken to ensure the accuracy of the material, The Trustee for Laing Weaver Family Trust T/A Salus Private Wealth and Finchley & Kent Pty Ltd will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.