The keys to high retirement confidence

.

How confident are you about your future retirement?

Do you think you’ll have enough money to achieve the retirement lifestyle you imagine?

And, importantly, what steps are you taking if any, or have you already taken, to help ensure you do?

They’re all key questions, and it’s evident from major retirement research that Vanguard has undertaken that Australians with the highest confidence about their future retirement tend to take the most purposeful action to prepare.

This may include accessing financial advice, having a detailed plan, and making regular extra contributions to their superannuation.

These are some of the key findings of Vanguard’s inaugural How Australia Retires study, which follows a survey of more than 1,800 working and retired Australians aged 18 years and older.

The aim of the study was to better understand the way Australians across different age groups feel towards their retirement, how they prepare for their retirement, and the role that superannuation plays in that preparation.

Among other things, we found that people with the lowest confidence about their retirement tend to be the least actively prepared.

Often they have never accessed financial advice and have little understanding of how they can achieve their retirement goals. They also expect to be more reliant on the government’s Age Pension after they retire than those with higher retirement confidence.

Preparation and planning

Interestingly, our research has found that having high retirement confidence is not dependent on age or income, but rather on having a plan.

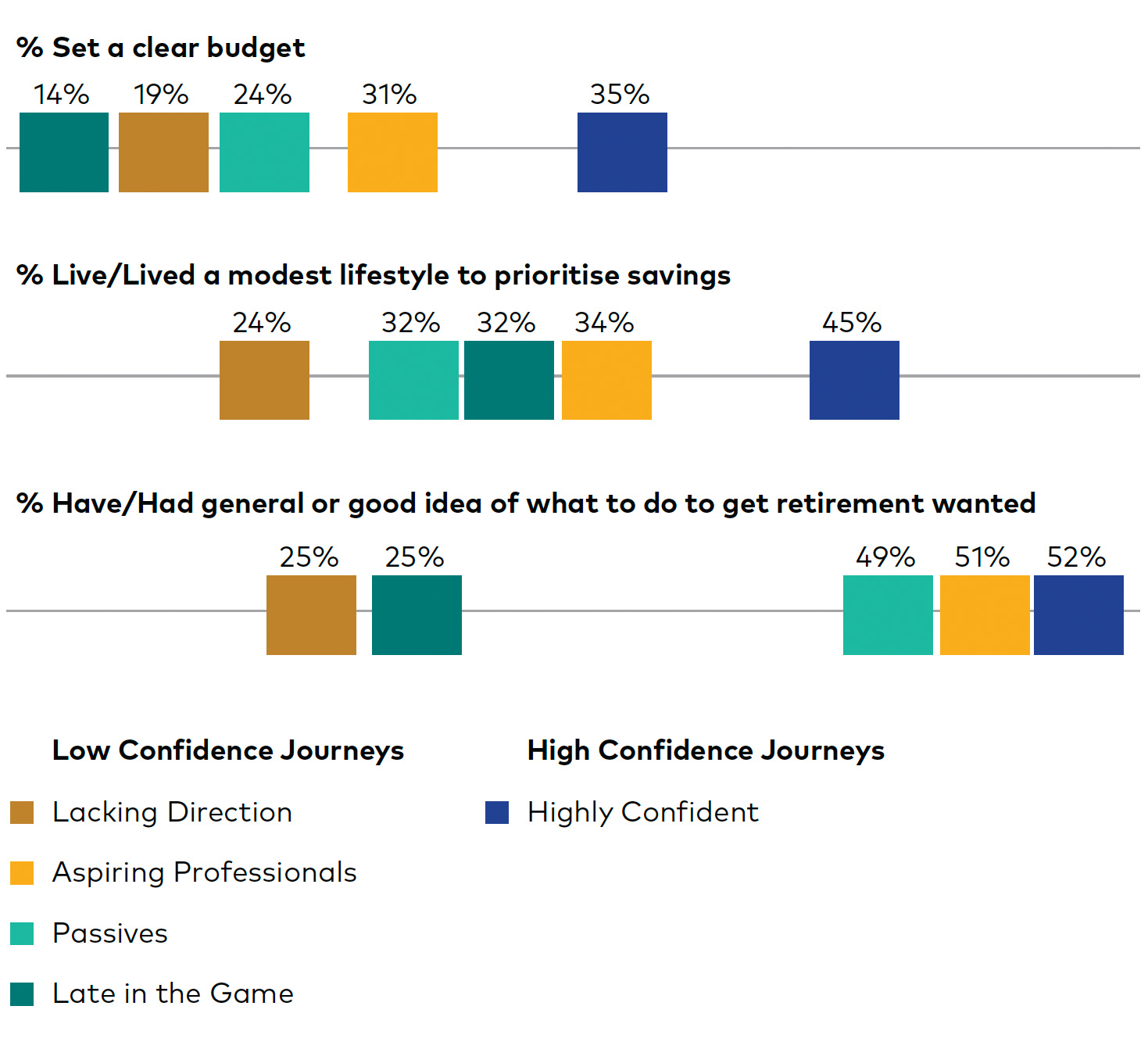

More than half (52%) of the people we surveyed who presented themselves as being highly confident about their retirement readiness feel that they know what they need to do to achieve the retirement outcome they desire and are optimistic about this phase of their life.

They are relatively likely to use budgets and prioritise their savings.

Source: Vanguard

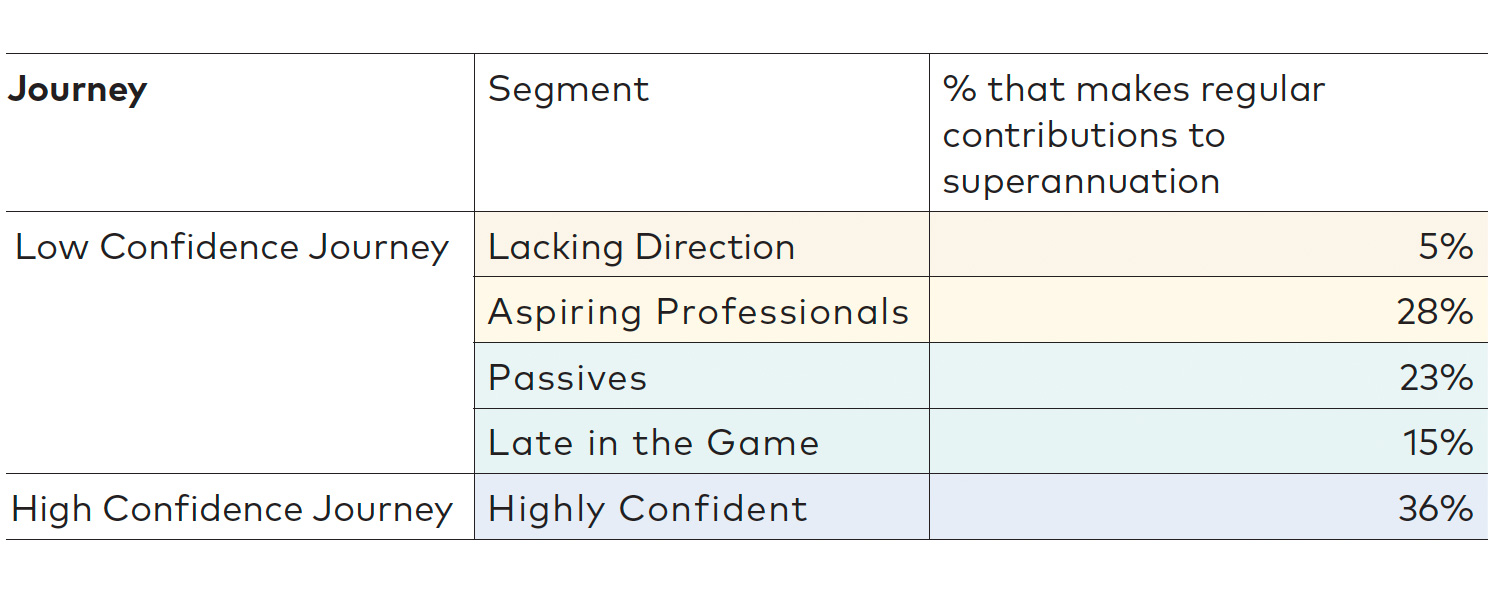

On the other hand, most Australians surveyed who presented as having low confidence about their retirement readiness do not have a plan and feel the most unprepared.

They do not tend to make regular additional super contributions and are generally less optimistic and more likely to feel disinterested, anxious or worried about this later phase of life.

Among the Australians surveyed who are generally older and who have typically taken less action to prepare, only 27% feel optimistic about retirement and just 23% feel very confident.

Many are concerned about not having enough income in their retirement and are uncertain about the actions they could take to achieve the retirement they envision.

Source: Vanguard

Superannuation and other investments

The How Australia Retires study also found that 50% of working-age Australians (those who did not identify as retired) consider super an important component of their retirement plan but expect to rely on it less than existing retirees.

As part of this, more than half of working-age Australians (54%) estimate that their super balance constitutes 50% or less of their total investment balance.

In addition, 1 in 4 working-age Australians highlight investment property as a key part of their retirement plan, with financial assets and their home making up the balance of their investments. By contrast, only 1 in 10 retired Australians cite investment property as an asset.

Lack of super engagement

Despite it still being an important component of total retirement assets, relatively few Australians engage with their super.

In fact, 1 in 4 working-age Australians are unsure about their current superannuation balance, and 1 in 2 are unsure what they pay in super fees.

In addition, 50% of working-age Australians have either not made contact with their superannuation fund in the last 12 months or have never made contact at all.

For retirees, this scenario is even more common, with almost 3 in 4 having not made contact in the last six months.

“An opportunity, and perhaps a need, therefore exists for the superannuation industry on the whole to improve member engagement, to simplify fee structures, and to support stronger retirement outcomes,” Vanguard Australia’s Managing Director, Daniel Shrimski, says.

To read the full How Australia Retires study

General advice warning

Vanguard is the product issuer and the Operator of Vanguard Personal Investor. Vanguard Super Pty Ltd (ABN 73 643 614 386 / AFS Licence 526270 is the trustee of Vanguard Super (ABN 27 923 449 966) and the issuer of Vanguard Super products. We have not taken your objectives, financial situation or needs into account when preparing this report so it may not be applicable to the particular situation you are considering. You should consider your objectives, financial situation or needs and the disclosure documents of any relevant Vanguard financial product before making any investment decision. Before you make any financial decision regarding a Vanguard financial product, you should seek professional advice from a suitably qualified adviser. A copy of the Target Market Determinations (TMD) for Vanguard’s financial products can be obtained at vanguard.com.au free of charge and include a description of who the financial product is appropriate for. You should refer to the TMD of a Vanguard financial product before making any investment decisions. You can access our IDPS Guide, Product Disclosure Statements, Prospectus and TMD at vanguard.com. au or by calling 1300 655 101. Past performance information is given for illustrative purposes only and should not be relied upon as, and is not, an indication of future performance. This report was prepared in good faith and we accept no liability for any errors or omissions.

Tony Kaye, Senior Personal Finance Writer

MAy 2023

vanguard.com.au